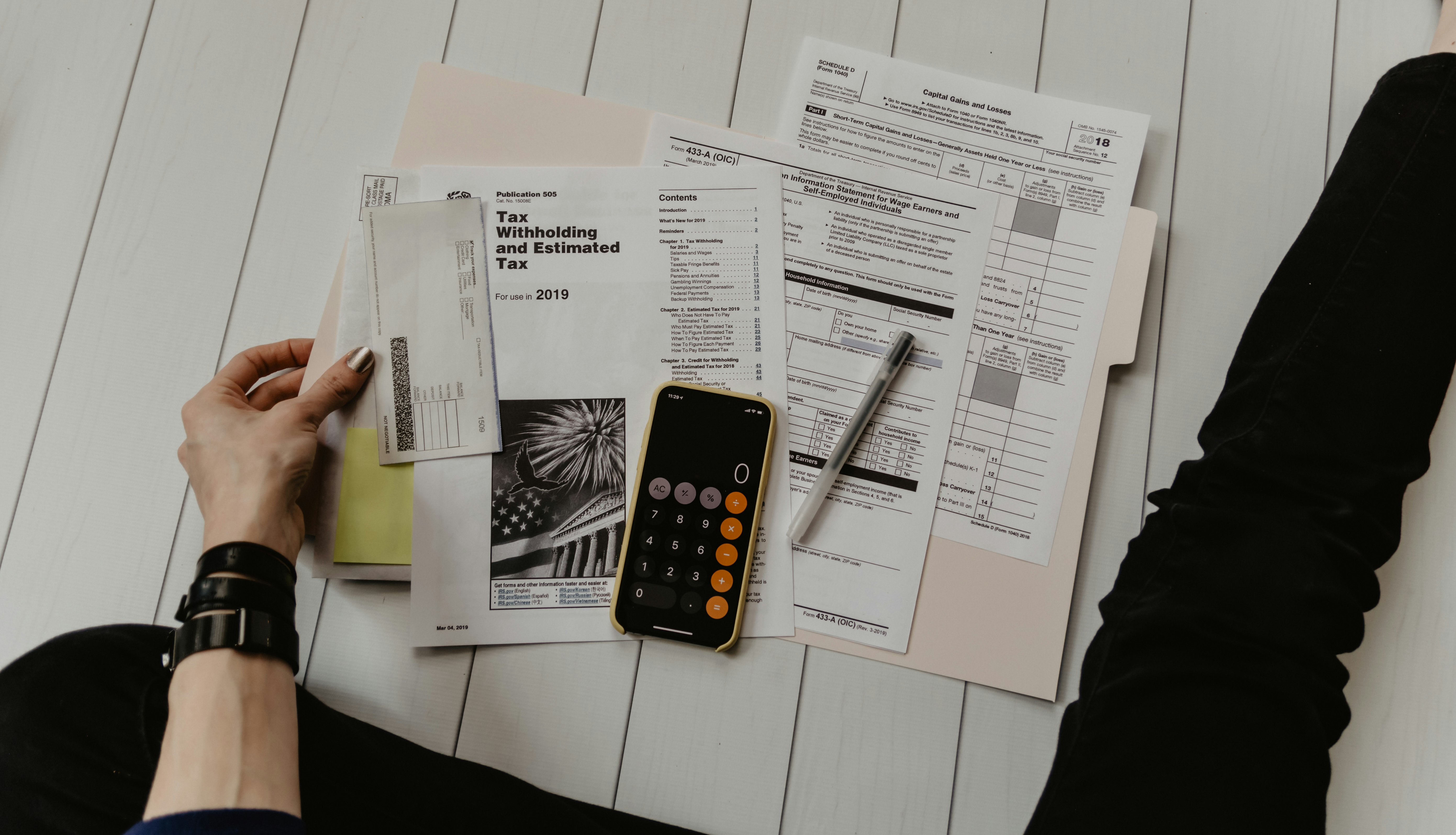

In today’s financial landscape, credit cards have become an indispensable tool for many individuals. They offer convenience, flexibility, and a range of benefits that can enhance your financial life. However, with great power comes great responsibility, and it’s crucial to understand the ins and outs of credit cards to avoid potential pitfalls. In this article, we’ll explore five key things you need to know about credit cards to make informed decisions and manage your finances effectively.

1. Interest Rates and Fees

One of the most important aspects of credit cards is the interest rate and fees associated with them. Interest rates can vary widely depending on the card issuer, your creditworthiness, and the type of card you have. It’s essential to understand how interest is calculated and how it can impact your balance over time. Additionally, credit cards often come with various fees, such as annual fees, late payment fees, and cash advance fees. Make sure to read the fine print and understand all the fees associated with your card to avoid any surprises.

2. Credit Score Impact

Your credit score is a crucial factor in determining your financial health. Using a credit card responsibly can have a positive impact on your credit score, while misusing it can lead to a negative impact. When you use a credit card, your payment history, credit utilization ratio, and length of credit history are all reported to the credit bureaus. Making timely payments and keeping your credit utilization low can help improve your credit score over time. On the other hand, missing payments, maxing out your credit card, or closing old accounts can have a negative impact on your credit score.

3. Rewards and Benefits

Many credit cards offer rewards and benefits to incentivize cardholders to use their cards. These rewards can include cash back, points, miles, or other perks. It’s important to understand the rewards program associated with your card and how to maximize your earnings. Some cards may have restrictions or limitations on how you can redeem your rewards, so make sure to read the terms and conditions carefully. Additionally, some credit cards offer additional benefits such as travel insurance, purchase protection, and extended warranties. These benefits can provide valuable protection and peace of mind when using your credit card.

4. Credit Card Fraud Protection

Credit card fraud is a serious issue that can have a significant impact on your finances. It’s important to take steps to protect yourself from credit card fraud, such as monitoring your account activity regularly, using strong passwords and PINs, and being cautious when sharing your credit card information online. Most credit card issuers offer fraud protection services to help detect and prevent unauthorized transactions. Make sure to understand the fraud protection policies and procedures of your card issuer and report any suspicious activity immediately.

5. Responsible Credit Card Use

Ultimately, the key to using credit cards effectively is to use them responsibly. This means making timely payments, keeping your credit utilization low, and only using your credit card for purchases you can afford to pay off. It’s also important to avoid carrying a balance on your credit card whenever possible, as this can lead to high interest charges and debt. By using credit cards responsibly, you can build a positive credit history, enjoy the benefits of credit card rewards and benefits, and avoid the potential pitfalls of credit card debt.

In conclusion, credit cards can be a valuable financial tool when used responsibly. By understanding the five key things discussed in this article, you can make informed decisions about your credit card use, manage your finances effectively, and avoid potential pitfalls. Remember to read the fine print, monitor your account activity regularly, and use your credit card responsibly to make the most of this powerful financial tool.

This Article Was Generated By AI.