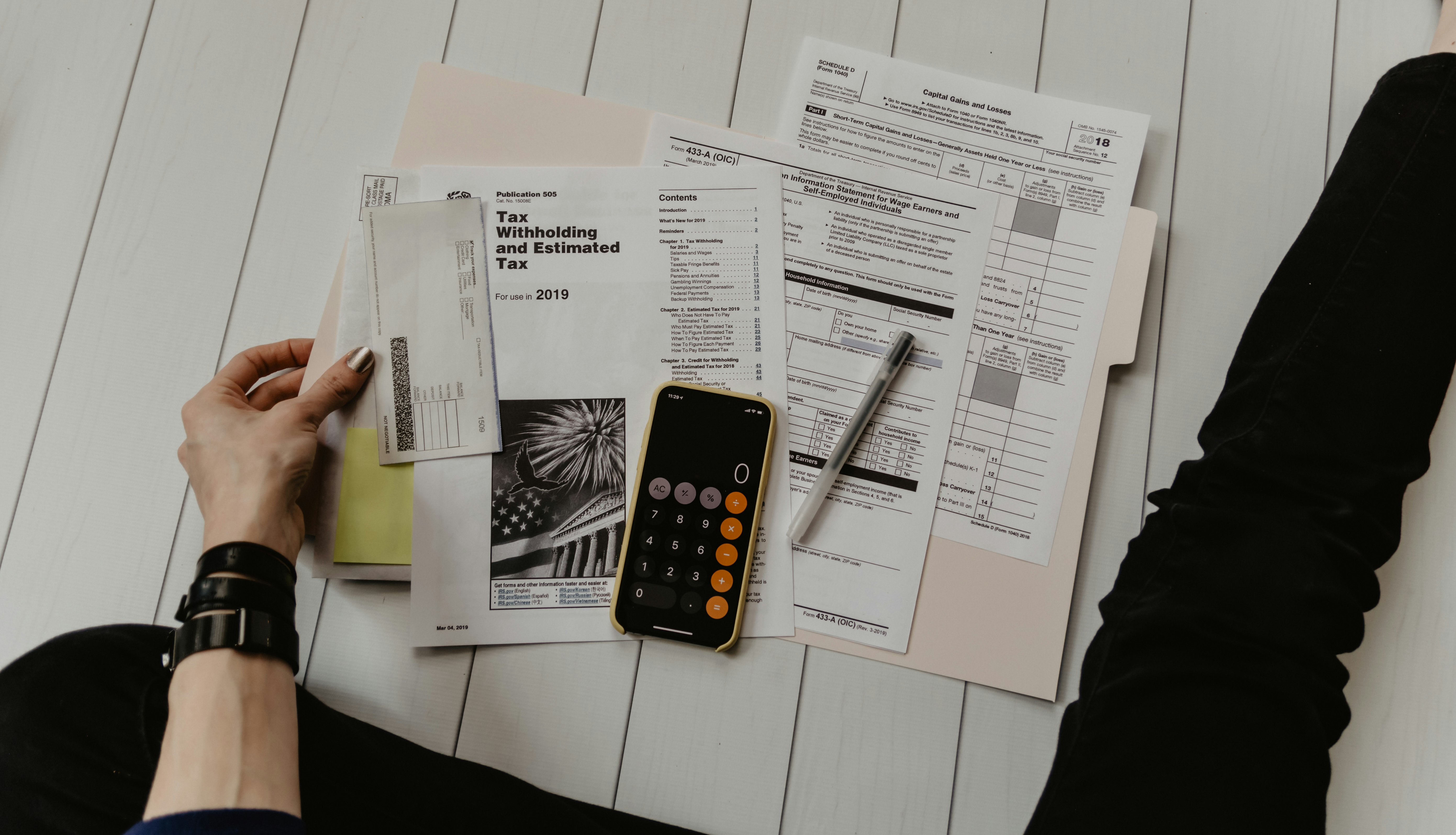

Homeownership is a significant milestone in many people’s lives. It represents stability, a place to create memories, and often, a substantial financial investment. Protecting this investment is crucial, and that’s where homeowners insurance comes into play. There are several types of homeowners insurance policies available, each designed to meet different needs and circumstances.

HO – 1: Basic Form

The HO – 1 policy is the most basic type of homeowners insurance. It provides coverage for a limited number of perils, typically including fire, lightning, windstorm, hail, explosion, riot, aircraft, vehicles, smoke, vandalism, and theft. However, it does not cover many common risks such as water damage from plumbing issues or damage caused by freezing pipes. This policy is rarely sold today because of its limited coverage, but it can be a cost – effective option for those with very low – risk properties and who are willing to accept a higher level of risk.

HO – 2: Broad Form

The HO – 2 policy offers broader coverage than the HO – 1. In addition to the perils covered by the HO – 1, it also includes coverage for damage caused by falling objects, weight of ice, snow, or sleet, and accidental discharge or overflow of water or steam from within a plumbing, heating, air – conditioning, or automatic fire – protective sprinkler system. This policy is a step up in terms of protection and is suitable for homeowners who want more comprehensive coverage than the basic HO – 1 but still want to keep costs relatively low.

HO – 3: Special Form

The HO – 3 policy is the most common type of homeowners insurance. It provides open – perils coverage for the dwelling and other structures on the property. This means that it covers all risks except those specifically excluded in the policy. For personal property, it provides named – perils coverage, similar to the HO – 2. The HO – 3 offers a high level of protection and is a popular choice for most homeowners as it balances comprehensive coverage with affordability.

HO – 4: Renter’s Insurance

While not strictly a homeowners policy, the HO – 4 is important for renters. It provides coverage for the renter’s personal property against named perils such as fire, theft, and vandalism. It also includes liability coverage, which protects the renter if someone is injured on the rented property and the renter is found to be at fault. This policy is essential for renters as it protects their belongings and provides liability protection, which is often not provided by the landlord’s insurance.

HO – 5: Comprehensive Form

The HO – 5 policy is an upgraded version of the HO – 3. It provides open – perils coverage for both the dwelling and personal property. This means that it offers the highest level of protection available for homeowners. It covers almost all risks, with only a few specific exclusions. However, this comprehensive coverage comes at a higher cost, so it is typically chosen by homeowners with high – value properties and valuable personal belongings.

HO – 6: Condominium Insurance

Condominium owners need a specialized policy, the HO – 6. It provides coverage for the interior of the condominium unit, personal property, and liability. The building’s common areas are usually covered by the condominium association’s master insurance policy. The HO – 6 fills the gaps in coverage and protects the individual condominium owner’s interests.

HO – 8: Older Home Insurance

For older homes, the HO – 8 policy is designed. These homes may have unique construction materials or features that make them more expensive to repair or replace. The HO – 8 policy typically pays the actual cash value of the damage, which takes into account depreciation. This policy is suitable for homeowners of older homes who want to protect their property but may not be able to afford the full replacement cost coverage.

In conclusion, choosing the right homeowners insurance policy is a crucial decision for homeowners. It is important to carefully assess your needs, the value of your property and belongings, and your budget. By understanding the different types of policies available, you can make an informed decision that will provide the necessary protection for your home and peace of mind for you and your family.

This Article Was Generated By AI